by Kenny | Oct 21, 2024

By Ian Berger, JD IRA Analyst The year is flying by, and before we know it 2025 will be here. With the arrival of the new year, several new provisions from the 2022 SECURE 2.0 law that impact retirement plans will become effective. One of the changes allows certain...

by Kenny | Oct 20, 2024

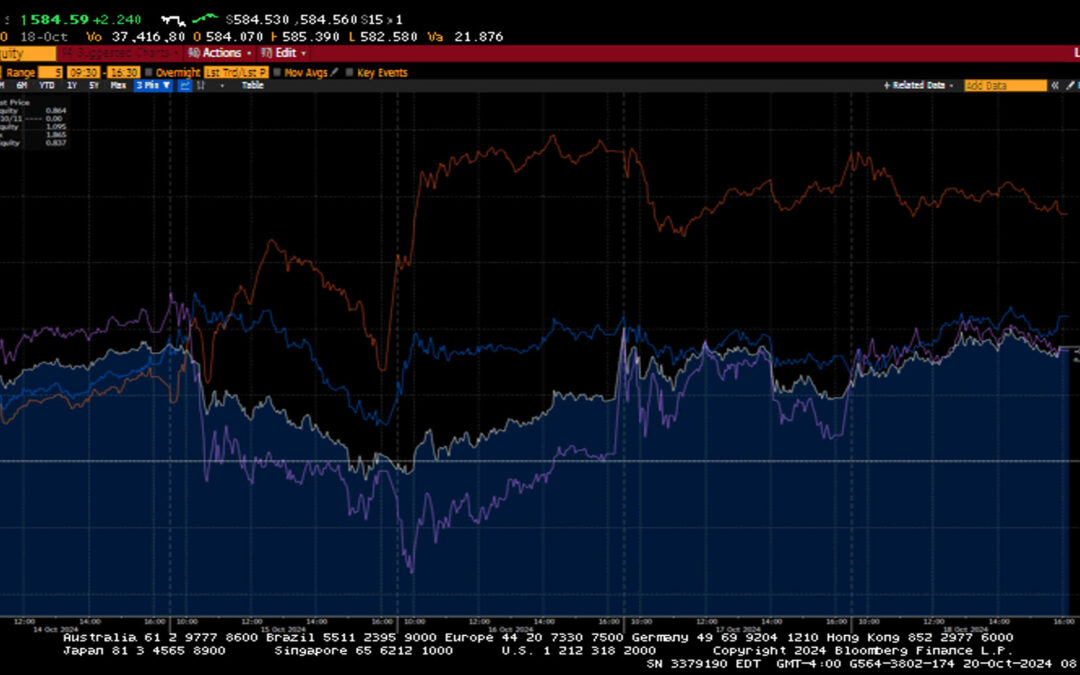

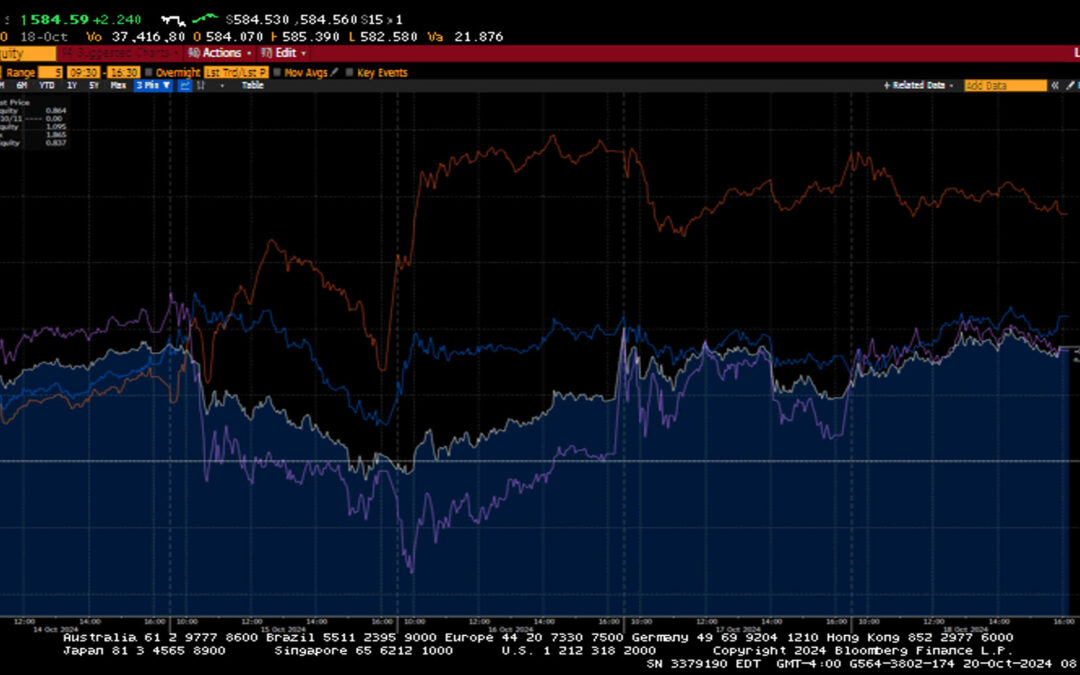

-Darren Leavitt, CFA The S&P 500 advanced for the sixth consecutive week, closing at a new record high. This week, a broadening out of the market’s rally was evident, with small caps and the equally weighted S&P 500 index outperforming. Markets also appear to...

by Kenny | Oct 17, 2024

Ian Berger, JD IRA Analyst Question: We have a client who has children from a previous marriage. Upon the husband’s death, he wants to make sure his current spouse has access to income from his IRA. But he also wants to make sure the remaining balance, when she...

by Kenny | Oct 16, 2024

By Sarah Brenner, JD Director of Retirement Education October 15, 2024 has come and gone. This was the deadline for correcting 2023 excess IRA contributions without penalty. If you missed this opportunity, you may be wondering what your next steps should be....

by Kenny | Oct 14, 2024

By Andy Ives, CFP®, AIF® IRA Analyst We have written about the net unrealized appreciation (NUA) tax strategy many times. Generally, after a lump sum distribution from the plan, the NUA tactic enables an eligible person to pay long term capital gains (LTCG) tax...

by Kenny | Oct 13, 2024

-Darren Leavitt, CFA The S&P 500 and Dow Jones Industrial Average forged another set of all-time highs despite facing several macro headwinds. Chinese markets reopened after celebrating Golden Week with significant losses. Investors were expecting an announcement...

by Kenny | Oct 12, 2024

By Andy Ives, CFP®, AIF® IRA Analyst QUESTION: Good afternoon, If a client passed this year with four adult children inheriting equally, and each beneficiary is using the 10-year rule, how do they determine yearly required minimum distribution (RMD)...

by Kenny | Oct 12, 2024

The Wall Street Journal recently published a story regarding diagnoses and plan payments in Medicare Advantage. The story was fundamentally flawed and overlooked the value of Medicare Advantage for millions of American seniors. Here are the facts: More than 33 million...

by Kenny | Oct 9, 2024

By Ian Berger, JD IRA Analyst Victims of Hurricane Helene have at least a glimmer of good news when it comes to their tax filings and ability to withdraw from their retirement accounts for disaster-related expenses. The IRS usually postpones certain tax deadlines for...

by Kenny | Oct 9, 2024

Everyone aspires to have a steady source of income after retirement that replaces as much as possible of their pre-retirement earning. But for many people, one big challenge in saving for that goal is to find the right financial product that accommodates their...

by Kenny | Oct 7, 2024

Sarah Brenner, JD Director of Retirement Education The recent final required minimum distribution (RMD) regulations include a new rule change that may be beneficial for IRA owners who name trusts as beneficiaries. In the new regulations, the IRS allows separate...

by Kenny | Oct 6, 2024

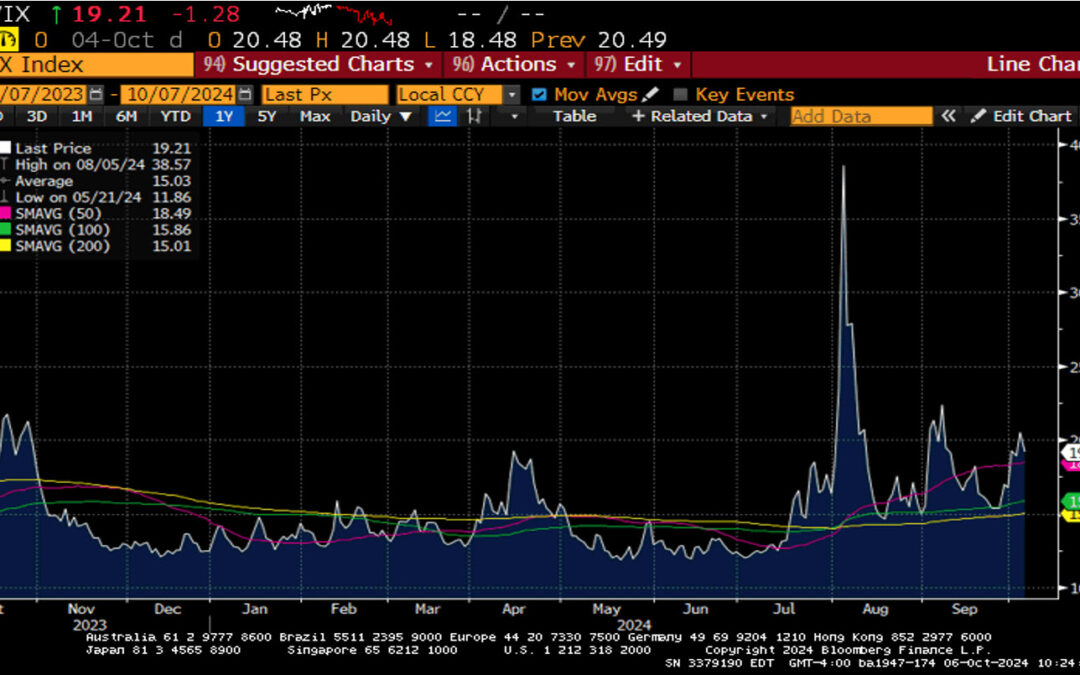

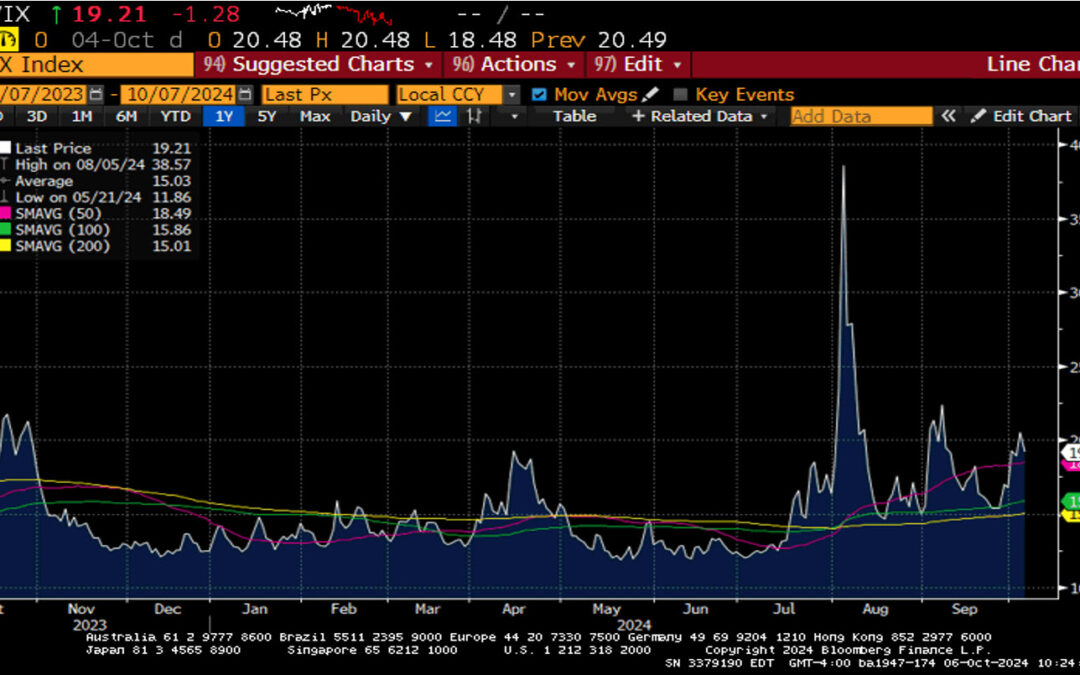

-Darren Leavitt, CFA The S&P 500 closed higher for a fourth consecutive quarter, the first time it has done so since 2011. Investors continued to face a challenging macro environment. Escalating tensions in the Middle East, a Longshoremen’s strike, the aftermath...

by Kenny | Oct 4, 2024

Today, more Americans than ever are choosing Medicare Advantage for affordable, quality health care — with over 33 million seniors and people with disabilities enrolled in the program. BMA wanted to learn more about seniors’ views on Medicare Advantage and how...

by Kenny | Oct 3, 2024

Summary – However, almost 8 in 10 workers and 7 in 10 retirees are concerned that the U. S. government could make significant changes to the American retirement system – A new report published today from the 34th annual Retirement Confidence Survey finds...

by Kenny | Oct 2, 2024

By Andy Ives, CFP®, AIF® IRA Analyst When a traditional IRA owner wants to convert all or a portion of his account to a Roth IRA, he needs to think long and hard about the transaction. For example, some questions to consider: 1. When will this money be needed?...

by Kenny | Sep 30, 2024

By Ian Berger, JD IRA Analyst A big change made by the SECURE 2.0 Act of 2022 was adding a new statute of limitations (SOL) for the IRS to assess penalties for missed required minimum distributions (RMDs) and excess IRA contributions. On its face, it looks like...

by Kenny | Sep 29, 2024

-Darren Leavitt, CFA US equity markets posted a third week of gains as global central banks continued to cut monetary policy rates. China, Switzerland, Mexico, Hungry, and the Czech Republic cut their policy rates. Chinese markets gained on the news that several...

by Kenny | Sep 27, 2024

How Medicare Advantage In-Home Health Assessments Keep Seniors Healthier Today, Medicare Advantage delivers affordable, high-quality care to more than 33 million seniors and people with disabilities, with better health outcomes than Fee-for-Service Medicare (FFS). One...

by Kenny | Sep 27, 2024

Critically underprepared for retirement, 55-year-old Americans enter a crucial 10-year countdown to plan and prepare With just a decade until retirement, 55-year-old Americans have less than $50K in median retirement savings First modern generation confronting...

by Kenny | Sep 26, 2024

Sarah Brenner, JD Director of Retirement Education Question: When an IRA owner dies after their required beginning date, can an eligible designated beneficiary choose either the life expectancy option or the 10-year payout rule? Answer: If an IRA owner dies on or...